Most people think flipping houses just means buying low and selling high—but that’s only what they’ve seen on HGTV. The truth is, there are seven distinct ways to flip a house, and once you understand all of them, every property becomes a potential deal.

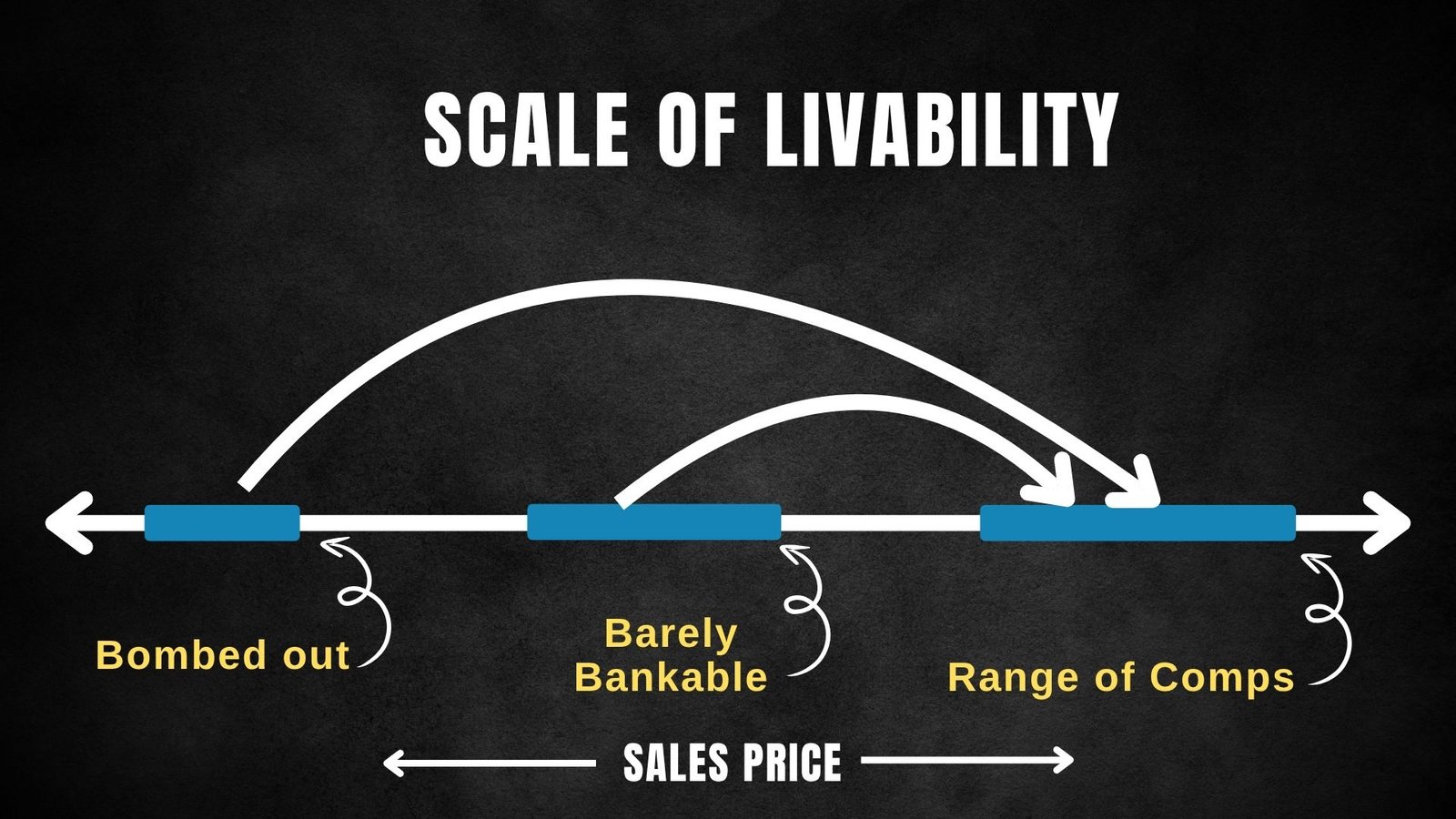

After flipping and holding over 300 properties myself, I’ve mapped out every strategy visually on what I call the Scale of Livability. It’s a framework that helps you see not just how to flip a house, but which type of investor you really are.

Let’s break them down.

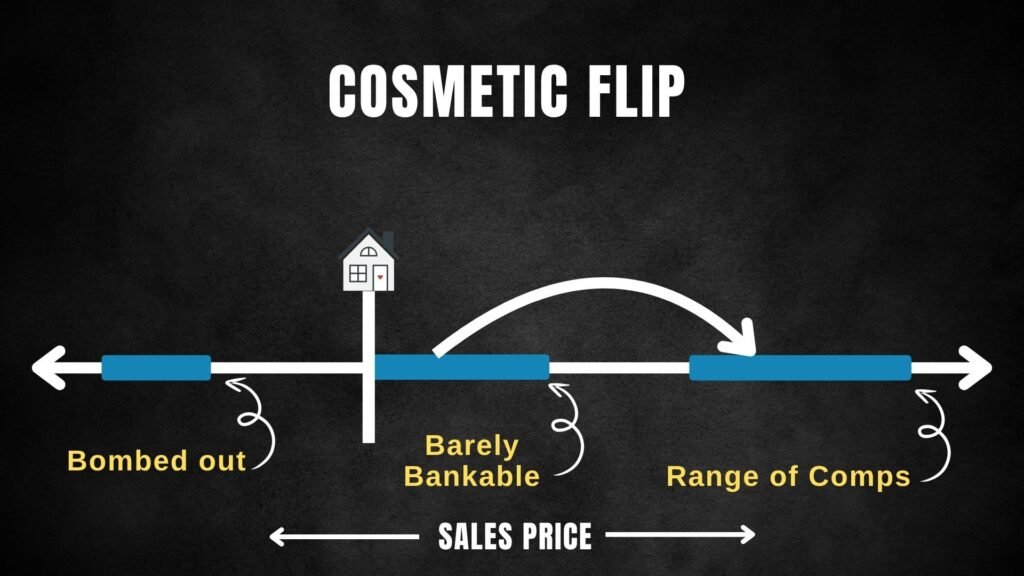

1. The Cosmetic Flip (aka the HGTV Flip)

This is what most people picture when they think of flipping. You buy a house that’s livable but outdated—something a bank will still lend on. I call this the Barely Bankable Range, sitting just to the right of the Livability Threshold on the Scale.

You’re not rebuilding the house. You’re giving it a facelift. Typical renovations cost around $15 per square foot and include:

- Floors and paint

- Cabinet repairs or repainting

- Trim and door touch-ups

- Countertops, backsplash, and vanities

- Minor landscaping

The goal is to move a house from outdated to modern and livable without pulling drywall or touching major systems.

Financing: Banks, private lenders, or even conventional mortgages work well here.

Caution: Everyone wants these. Because they’re low-risk, competition is fierce, and profit margins are thinner. Serious investors eventually move into deeper territory.

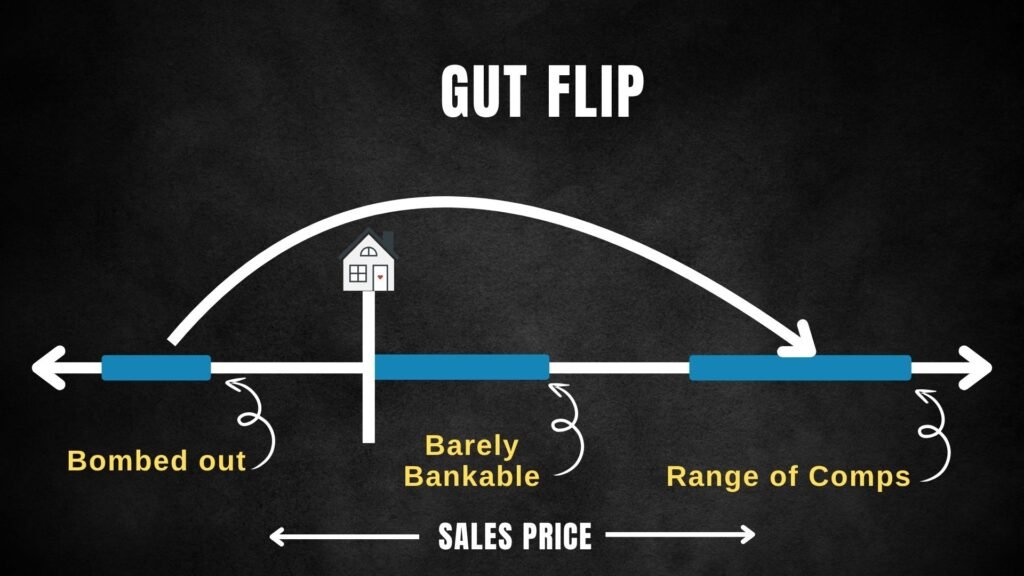

2. The Gut Flip (aka the Zombie Flip)

This is the other HGTV favorite—buy a bombed-out house, make it beautiful, sell for big profits.

Guts require total renovation. You’re pulling drywall, replacing insulation, and starting from the studs. Expect around $65 per square foot and major work on what I call the Quick 6:

- HVAC

- Plumbing

- Electrical

- Structural

- Roofing

- Windows/Siding

In a gut, nearly every system is replaced. These projects are riskier but more profitable, and the deals are easier to find because fewer buyers are capable of managing them.

Financing: Hard money, private money, or cash. Traditional banks won’t lend on unlivable homes.

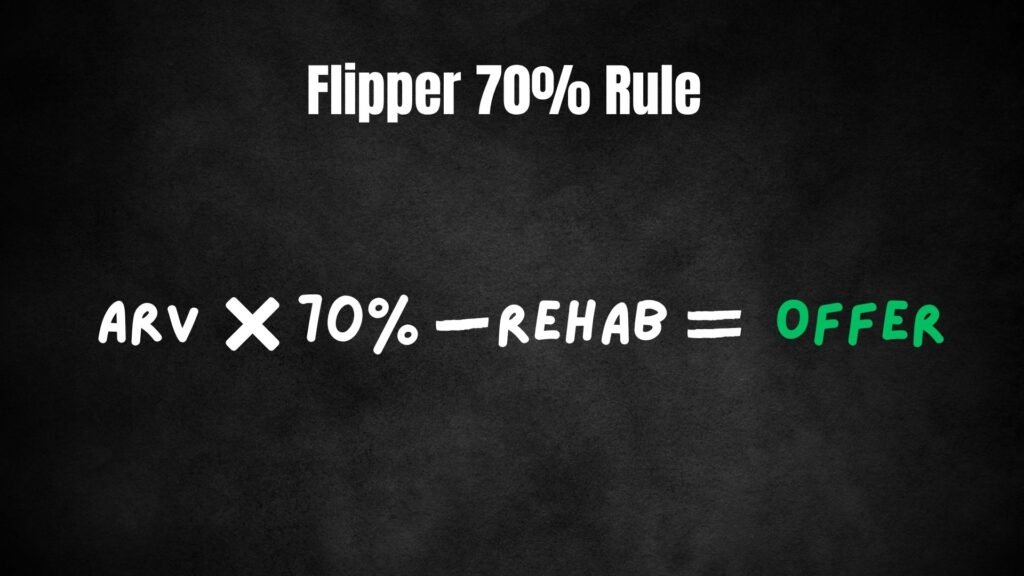

Rule of Thumb: Use the 70% Rule – never pay more than 70% of the ARV (After Repair Value) minus repair costs.

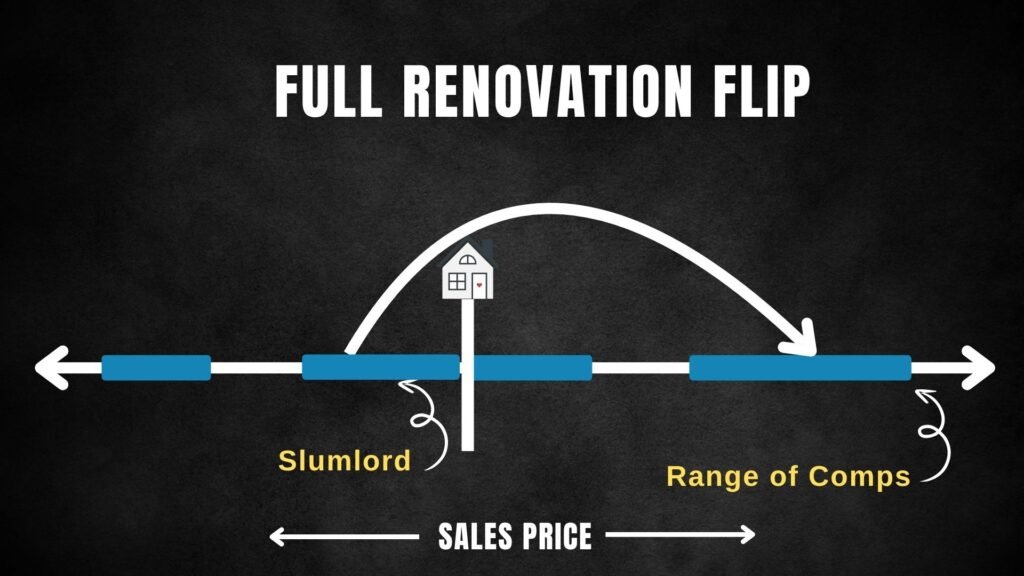

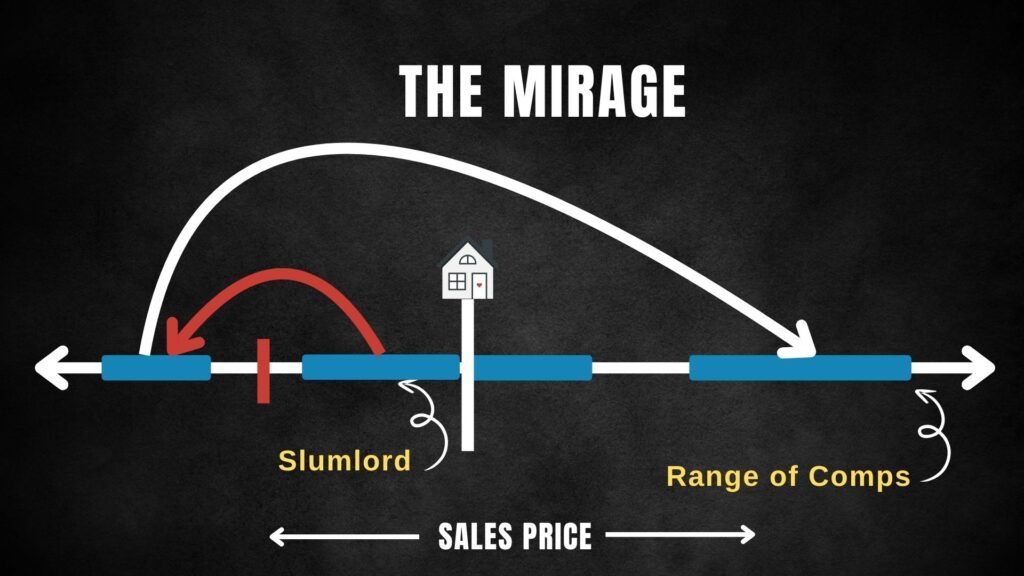

3. The Full Renovation Flip

This sits between the Cosmetic and the Gut. The drywall can stay, but the home isn’t livable as-is—often because of failed utilities or unsafe conditions.

Renovations here run around $35 per square foot. You’re repairing most of the Quick 6 but replacing only what’s necessary. Think new floors, updated kitchens, repaired roofs, and functional systems. The danger here is what I call The Mirage—thinking it’s a renovation when it’s secretly a gut. Always inspect the structure and electrical closely.

Financing: Hard money, private money, or commercial loans. Traditional banks still won’t touch it.

Goal: Bring the property just over the Livability Threshold so it can qualify for conventional lending.

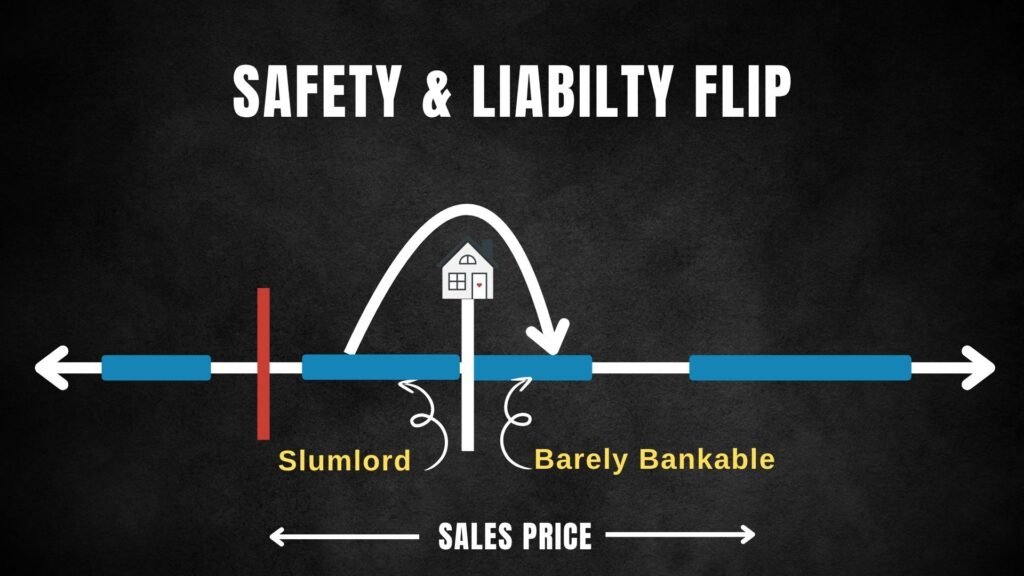

4. The Safety & Liability Flip (aka the Landlord Flip)

Not every flip has to be glamorous. The Landlord Flip exists for homes that have been neglected by slumlords. They may technically be livable, but not safely.

These flips are focused on code compliance and safety—a rehab budget under $20,000. Your goal isn’t aesthetic; it’s legal and functional. Fix anything that could cause injury, lawsuits, or code violations:

- Fix leaks, gas lines, or broken HVAC

- Replace shattered glass or unsafe stairs

- Ensure fire alarms, egress, and railings meet code

- Handle environmental hazards like mold, asbestos, or lead

Once the property is safe, you can rent it out or sell it to another investor who wants a stabilized asset.

Financing: Hard money, private money, or cash.

Tip: Even if you’re doing another flip type, run this checklist. Safety repairs always come first.

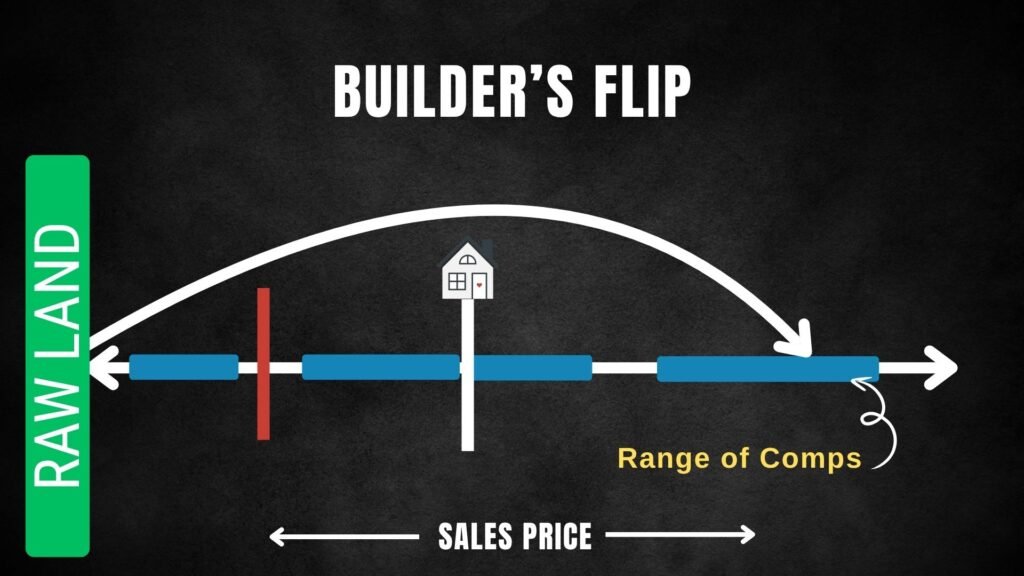

5. The Builder’s Flip

This is where flipping meets new construction. You’re either adding square footage (like a 500-square-foot addition) or doing a ground-up build.

The math works when your after-build value justifies the construction cost:

- Example: Houses sell for $300/sf at 1500 sf ($450K total). Adding 500 sf brings it to $600K—a $150K jump for the same location.

Build costs range from $80–$200 per square foot, depending on land, design, and finishes. These projects require permitting, GC-level oversight, and higher risk tolerance.

Financing: Construction loans, hard money, or private equity. These are advanced projects but can be highly profitable.

6. The Grey Collar Flip

You can flip houses with your mouth instead of a hammer.

This category includes wholesaling and wholetailing.

- Wholesaling: Get a property under contract and sell your position to another buyer. No renovation required.

- Wholetailing: Buy a deeply discounted home, make minimal repairs ($5K or less), clean it out, and relist it.

These strategies make money through sales and marketing skill, not construction. They’re perfect for people who are good at finding deals and negotiating but don’t want to swing a hammer.

Financing: Depends on property condition—if livable, even conventional loans can work.

7. The White Collar Flip

This is the most advanced tier—flipping through paperwork and problem-solving rather than physical rehab.

Examples include:

- Zoning or Easement Settling

- Lot Splitting for additional parcels

- Property Management Turnarounds in multifamily buildings

These projects require specialized knowledge, patience, and sometimes legal navigation—but the upside can be massive. You might turn a single-family home into two lots or convert a mismanaged building into a high-performing asset.

Financing: Highly situational—depends on zoning, land, and use.

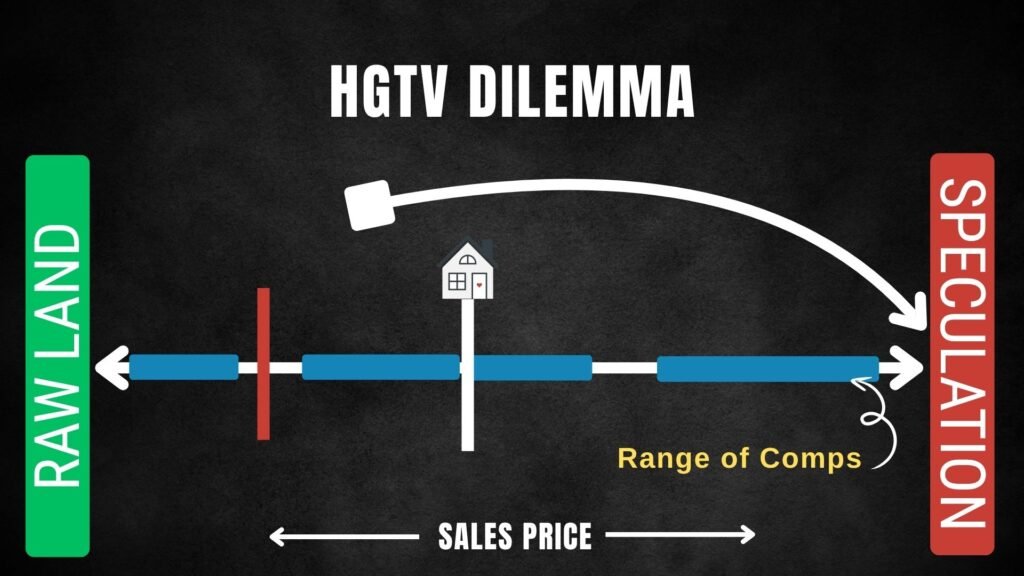

The HGTV Dilemma (and the 4 Pitfalls to Avoid)

Before you rush into any flip, beware of these traps:

- The HGTV Dilemma – Over-renovating for the neighborhood. Just because you can make it pretty doesn’t mean buyers will pay for it.

- The Mirage – Thinking a house only needs a renovation, then discovering it needs a gut.

- The Host – Designing it like you’d live there instead of for the market.

- Give a Mouse a Cookie – One upgrade leads to another until your budget implodes.

Remember: Livable means monetizable. Every renovation should move the house up the livability scale just far enough to hit your exit strategy—no further.

The Best Part: Every Flip Can Become a Rental

Here’s the hidden truth: any house that can be flipped can also be held.

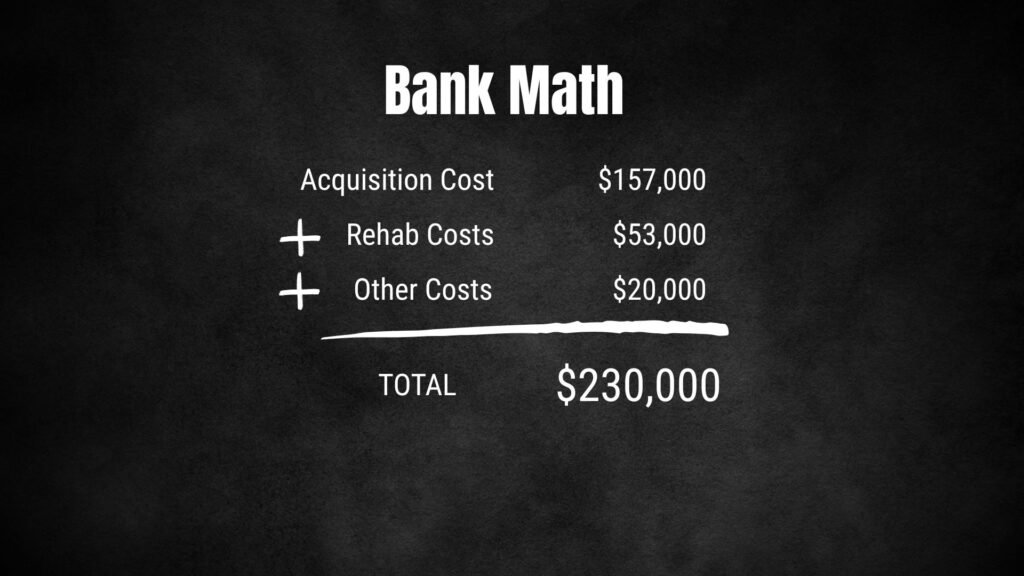

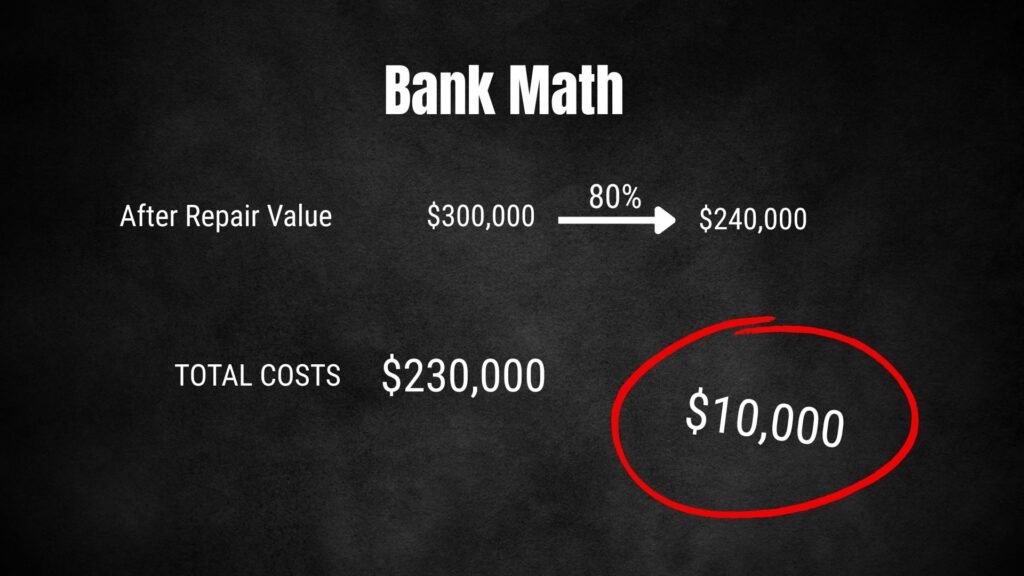

If you use the 70% Rule, you’re usually all-in for around 80% of the ARV. Banks will refinance up to 80% of the appraised value, meaning you can pull out your initial investment and keep the asset as a rental.

That’s the BRRRR method in disguise—and it’s how you turn short-term flips into long-term wealth.

By the way – I’ve made an advanced, quick calculator to replace the 70% Rule.

Final Thoughts: Choose Your Flip Type Intentionally

Once you understand all seven strategies, you realize flipping isn’t about the house—it’s about matching the right approach to the right property.

The cosmetic investor, the builder, the wholesaler, the problem-solver—they all operate on the same street but play entirely different games.

So the question isn’t whether you should flip.

It’s which type of flipper you want to be.

One more thing…..

To quickly assess the price of a rehab I’ve built Fliporithm.