I’ve wholesaled over 300 houses in my career—and I regret it.

Not because it wasn’t profitable, but because of this feeling in my gut that I still can’t shake.

Now, I know that’s going to ruffle some feathers.

Because on paper, wholesaling makes sense. It’s defensible. It’s efficient. It fills a gap in the market.

But if that’s true, then why has everyone I know who used to wholesale quit for the same exact reason?

That’s what this is really about. I want to give you the truth, not to discourage you, but to help you decide for yourself.

Then, I want to show you how to stay in the game without crossing the line.

What Wholesaling Really Is

If you already know how wholesaling works, you can skip ahead.

But here’s the quick version.

Let’s say you see a house listed on Zillow for $200,000.

You call the owner or agent and say, “I’ll buy this.”

You both sign a contract to close in 30 days.

Before that closing date comes, you find another buyer willing to pay $220,000 for it.

Instead of buying the house yourself, you assign your purchase contract to that buyer and keep the $20,000 difference.

That’s wholesaling in a nutshell—no financing, no ownership, no repairs.

Just connecting a seller who wants out with a buyer who wants in.

It’s arbitrage.

And the world runs on arbitrage.

You don’t drive to a banana plantation to get bananas.

You don’t visit an oil rig to fill up your gas tank.

There’s always someone in the middle—someone who bridges the gap, who makes messy assets liquid.

That’s what wholesalers do.

Why Wholesaling Works (and Feels Wrong)

Wholesalers serve a real purpose.

They help sellers offload distressed properties quickly. They handle the paperwork.

They deal with title issues nobody else wants to touch.

They spend thousands on marketing just to find these leads.

And yes, they deserve to get paid for that.

But here’s where things get complicated.

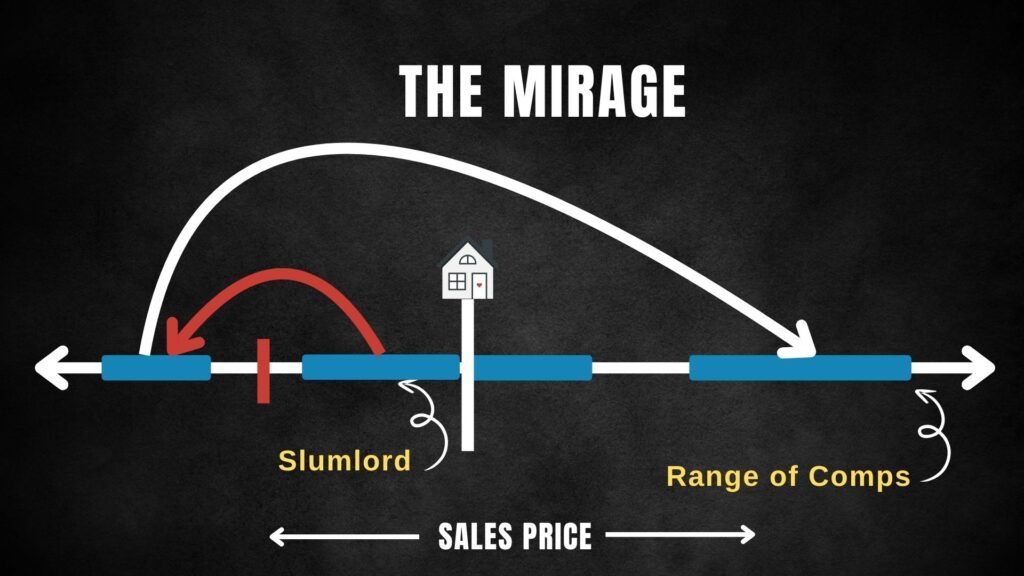

Because to make wholesaling work, you have to buy under market value.

That’s the only way you make the spread.

And that’s where the line starts to blur.

You’re not buying or selling houses—you’re selling contracts.

And you’re often negotiating with people who are vulnerable, stressed, and underinformed.

Even when the numbers make sense, something deep inside you starts to whisper: Is this right?

The Carpetbagger Problem

Let’s take a quick detour into history.

After the Civil War, the South was in ruins.

People were desperate to sell land and rebuild their lives.

And then came a wave of opportunists—Northern businessmen with cash—offering quick deals to buy up property cheap.

They were called carpetbaggers because they carried their belongings in bags made of carpet.

On paper, these guys were heroes. They brought liquidity, rebuilt towns, and reactivated local economies.

But history didn’t remember them that way.

History remembered them as exploiters.

Even though their deals were “fair,” everyone knew who came out ahead—and who got left behind.

That’s what wholesaling started to feel like for me.

A clean deal on paper. A sour deal in the gut.

The Truth About Exploitation

Look, I’m no softy. I’m a capitalist, through and through.

I’ve done deals with human waste in the living room.

I’ve closed in seven days when a seller desperately needed cash.

I’ve had sellers thank me afterward.

So, yes—many of my deals felt fair and even helpful.

But here’s what I couldn’t ignore:

Every time there’s a $40,000 spread, there’s temptation.

Temptation to push the limits.

To blur the truth.

To justify it because it’s just business.

And that’s the slippery slope.

Wholesaling, by definition, is “exploiting price differences.”

That’s the literal dictionary definition.

And if I, as a professional investor, have never felt exploited by the price I paid for a house—then who’s being exploited?

That question kept me up at night.

The Gut Feeling That Doesn’t Go Away

Over time, I started to notice a pattern.

Everyone I knew who had been successful at wholesaling eventually started to feel the same way I did.

It’s not guilt. It’s not shame. It’s more like a quiet unease.

A sense that even though everything’s technically above board, something about the dynamic feels off.

That’s when I realized what I really wanted:

To earn my money by adding value to the world, not just extracting it.

And that’s how I ended up here—building real value through the Solo House Flipper model.

Because financial freedom means nothing if you can’t sleep at night.

The Three Ways to Stay on the Right Side of the Line

Now, I’m not here to moralize. I’m here to give you tactics.

If you still want to do deals, here are the three ways to do it right.

1. Be Completely Honest

Tell the seller exactly what you’re doing.

Explain how wholesaling works and what your role is.

Say you have a huge list of buyers who buy houses like theirs—and you’re connecting the dots.

But don’t lie about being the buyer if you’re not.

Just know that in many states, this crosses into “brokering,” which may require a license.

So, talk to an attorney before you do it.

2. Bird-Dog for Experienced Investors

Find an investor with cash who buys houses and doesn’t have time to hunt for deals.

Ask them what they want—price range, location, condition—and go find it.

Before you sign any contract, confirm with that investor that they’ll buy it.

If they say yes, you close it, collect your fee, and move on.

Everyone wins.

And if they ever flake, you never work with them again.

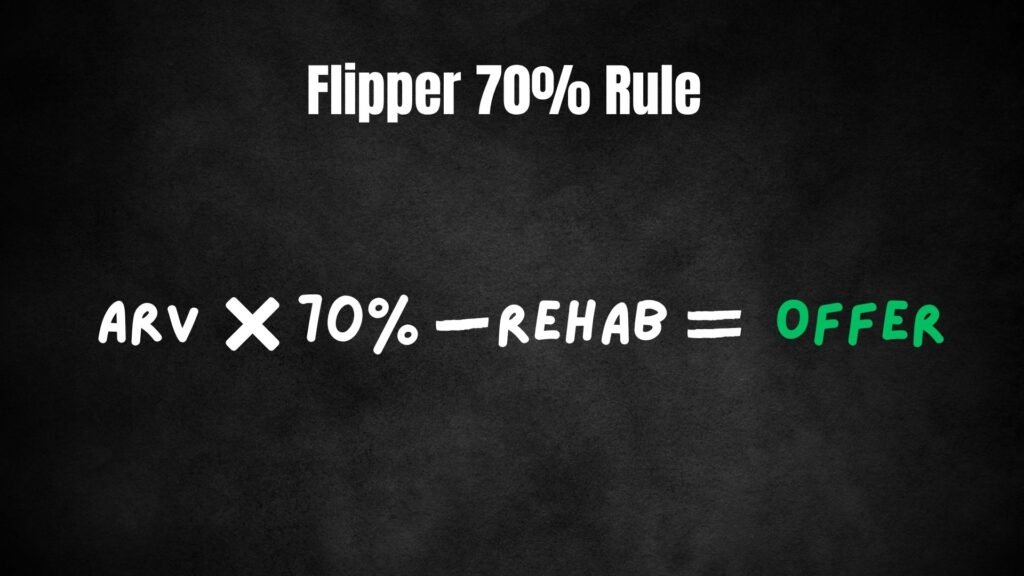

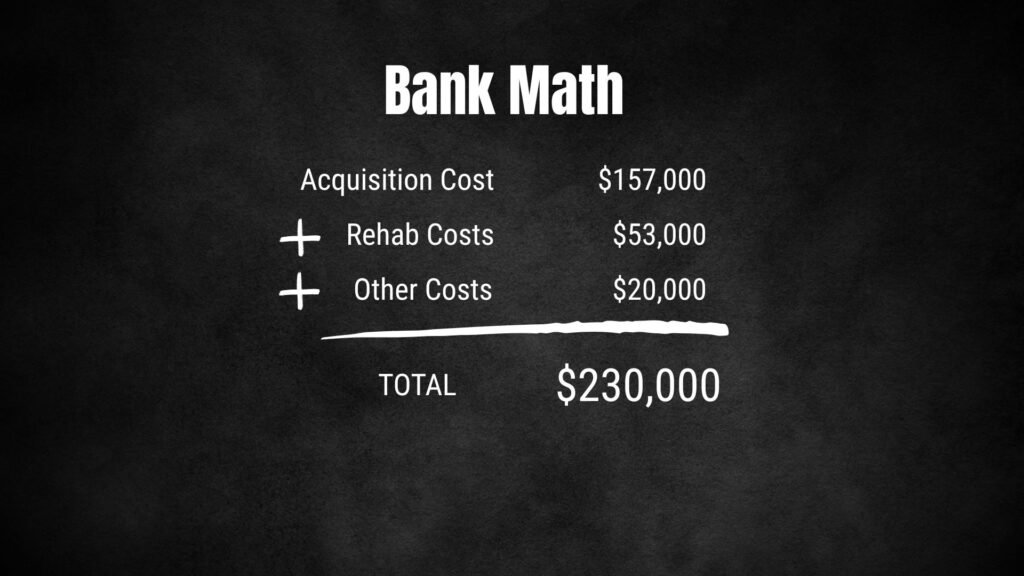

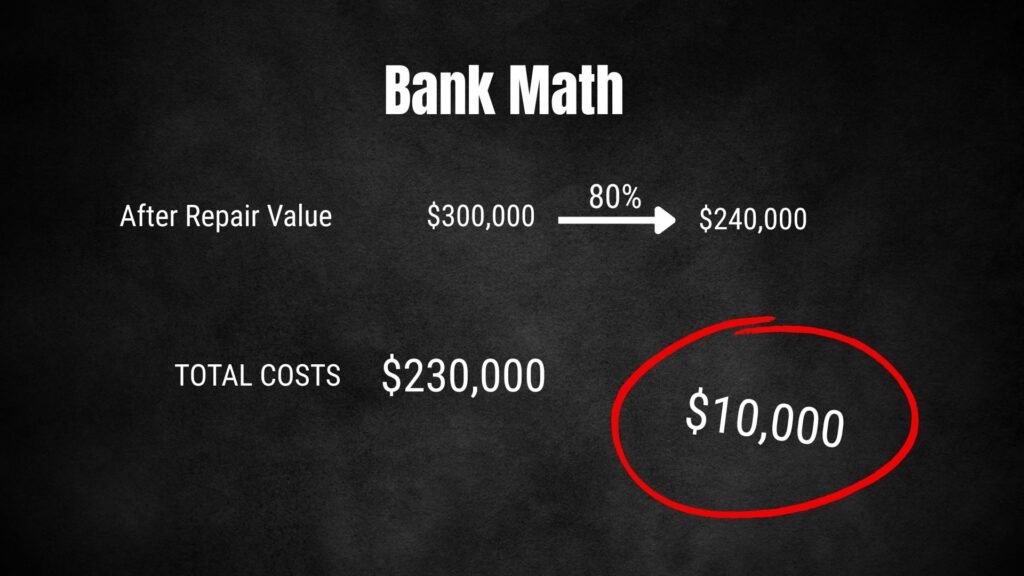

3. Buy It Yourself

The gold standard.

If you’re willing to buy the property yourself, you can’t go wrong.

Because when you’re taking the risk, you deserve the upside.

Sometimes that upside disappears—like the time I bought a house with 400 tires in the backyard and a roach infestation that ate my profit alive.

But that was my risk to take.

That’s the game.

And if you genuinely intend to buy a property but later assign it to another investor—as long as you’re fully ready and willing to close yourself—that’s fair.

That’s honorable.

The Real Problem

The problem isn’t making money.

The problem is locking up houses you can’t or won’t buy—taking advantage of people who don’t understand what’s happening.

That’s what leaves the bad taste in your mouth.

That’s what makes you lose sleep.

But if you’re willing to stand behind your deals, write the checks, and deliver real value, you can still make a fortune in this business—and keep your integrity intact.

Final Thoughts

Most wholesalers who last long enough eventually feel that same gut pull.

They realize there’s a right way and a wrong way to make money.

And they start shifting toward building, not arbitraging.

Because good sales isn’t trickery—it’s deal-making.

And good deals come from being genuine.

That’s why I say this:

Skills are the real wealth in this game.

Learn to negotiate.

Learn to build.

Learn to lead.

And as you do, keep this question close:

How would you feel if your actions made the front page of the news?

Or simpler—how would you feel if your kids saw what you’d done?

For me, that question changed everything.